Overall, currencies remain well bid against the USD, with the Euro once again looking to extend gains to fresh yearly highs beyond 1.3700 on Tuesday. A combination of hawkish comments from ECB President Trichet and improved sentiment towards the Eurozone, in light of what appears to be a comprehensive support package, have contributed to the relative strength. Technically, while we continue to look for opportunities to buy USD’s over the medium-term, there is certainly room for additional Euro gains from here, and we eye a potential move just shy of 1.4000 before the market once again looks to roll over in favor of broader USD gains.

Relative Performance Versus USD Tuesday (As of 10:00GMT)

- SWISSIE+0.24%

- YEN +0.23%

- KIWI+0.10%

- EURO-0.11%

- CAD-0.22%

- AUSSIE-0.31%

- STERLING-1.26%

The big story on the day has come out of the UK, with the Pound showing weakness all day and then accelerating to the downside following a much weaker than expected growth reading. This opened a drop of well over 200 points in Cable on the day and put pressure on the UK against the other major currencies as well. Of course, attempts were made to mitigate the results, with Chancellor Osborne downplaying the results of the weather impacted data. The Bank of England is in a tough position where they need to balance between the threat of rising inflation (which is very real) and a shaky economic recovery. The Sterling market had been well bid in recent days on stable economic results and higher inflation readings, but has since come back under pressure following the latest GDP result.

Elsewhere, the Australian Dollar has also been loser on the day. Although the single currency is only marginally lower on the day against the buck at this point, we continue to see relative weakness ahead, with a combination of softer economic data and narrowing yield differentials in favor of other major currencies driving the relative weakness. The latest inflation data certainly does not help the antipodean’s cause, with a much softer CPI print earlier today, providing added support for the idea that the RBA will continue to remain on hold going forward. The Australian central bank has been in a period of transition, with the RBA moving away from a hawkish monetary policy to a more balanced policy. Meanwhile, other major central banks look to be on the verge of shifting away (if they have not done so already) from super accommodative policies.

Moving on, as was widely expected, the Bank of Japan came out and left rates unchanged with the overnight call rate holding at 0-1.10%. Meanwhile, the BOJ maintained its economic assessment with economic growth in 2011, 20112 and 2013 seen growing at 3.3%, 1.6% and 2.0% respectively. Also in Japan, MOF Noda said that the 2011 budget needed to be passed by the end of March to rid deflationary concerns, but there has been some resistance within the government and the passage of the budget may prove to be a difficult task with some speculating that PM Kan will have to make some serious personnel changes in order to achieve government goals re the budget.

On the strategy side, we have been looking for opportunities to buy USD/CAD on dips in recent days, and USD/CHF is now back on our radar, with a move towards the 0.9400 figure viewed as a potential counter-trend long opportunity. We will let you know as things progress throughout the day, but right now, it looks as though our next recommendation will be in one of these two currencies.

Looking ahead, all eyes turn to Canada, where inflation data (CPI- 0.2% expected) is set for release at 12:00GMT. US Case Shiller (-0.9% expected) is then out at 14:00GMT, with consumer confidence (54.3 expected), the house price index (0.0% expected) and Richmond Fed manufacturing (23 expected) capping things off at 15:00GMT. US equity futures are marginally lower while commodities are being hit harder with oil down some 1.50% and gold off by 0.50%.

TECHNICAL OUTLOOK

EUR/USD:The recent break back above 1.3500 has signaled a shift in the short-term structure and now potentially opens the door for additional upside over the coming days back towards the 1.4000 area. Next key topside resistance comes in by 1.3745 (61.8% of Nov-Dec move, while above exposes the 78.6% fib retrace off of the same move at 1.3985. Overall however, our core bias remains net USD bullish and as such, rallies to 1.3985 this week will be aggressively sold. In the interim, a break and close back below 1.3540 will be required to relieve topside pressures.

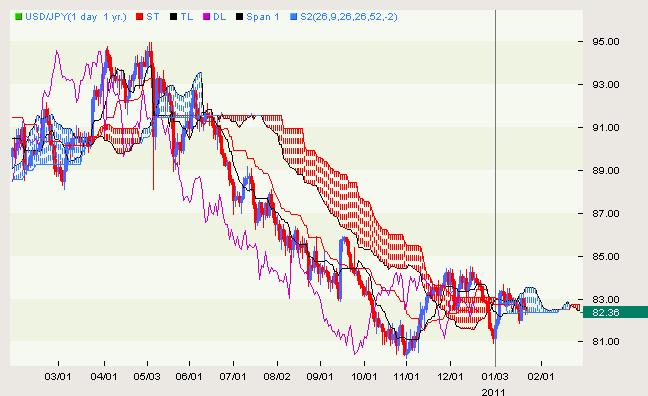

USD/JPY: The market appears to be locked in some consolidation with clear directional bias not easily determined. The latest rally has stalled out by the Ichimoku cloud top to suggest that the pressure still remains on the downside for now. Back below 82.00 should accelerate declines and expose the multi-year lows from 2010 just ahead of 80.00, while back above 83.70 will relieve downside pressures and shift structure back to the topside. In the interim, we remain sidelined and await a clearer signal.

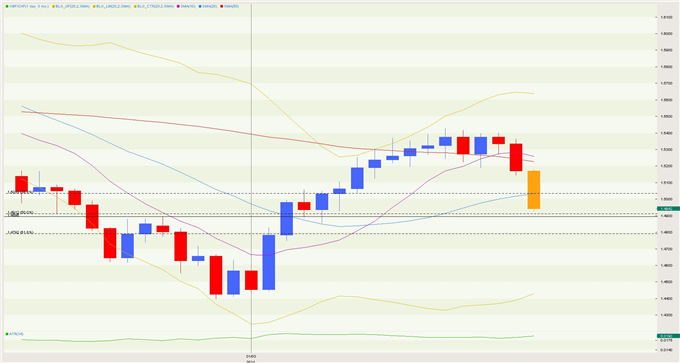

GBP/USD: A major bearish reversal day in the works and could now confirm a fresh lower top in place by 1.6060 ahead of the next major downside extension. Tuesday’s break back below 1.5840 helps to strengthen bearish bias, while a daily close below this level will further reaffirm. From here, look for any intraday rallies to be well capped ahead of 1.5900 in favor of a drop towards next support by 1.5665 further down. Only back above 1.6060 negates.

USD/CHF: Overall price action is certainly concerning for our longer-term basing outlook with the market dropping to fresh record lows by 0.9300 thus far. However, cyclical studies are showing oversold and any additional declines below 0.9300 are not seen as sustainable. Look for the current setbacks to be well supported on a close basis above 0.9400, with a fresh higher low sought out ahead of the next major upside extension beyond 0.9785.

TRADE OF THE DAY

GBP/CHF:While we acknowledge that on the fundamental front today’s data was certainly not pretty, we also can not ignore intraday technicals which are showing severely oversold. The daily ATR has already been well exceeded and hourly studies are violently stretched. On the daily chart we see evidence of longer-term basing, and as such we like the idea of buying into this latest dip below critical psychological barriers by 1.5000 in anticipation of a fresh higher low above the record lows set in late 2010. A key 50% fib retrace off of the latest Dec-Jan low high move and some solid previous resistance now turned support come in by the 1.4900 figure, and we will use this figure as our ideal entry for today’s trade. STRATEGY: BUY @1.4900 FOR AN OPEN OBJECTIVE; STOP 1.4730. RECOMMENDATION TO BE REMOVED IF NOT TRIGGERED BY NY CLOSE (5PM ET) ON TUESDAY.